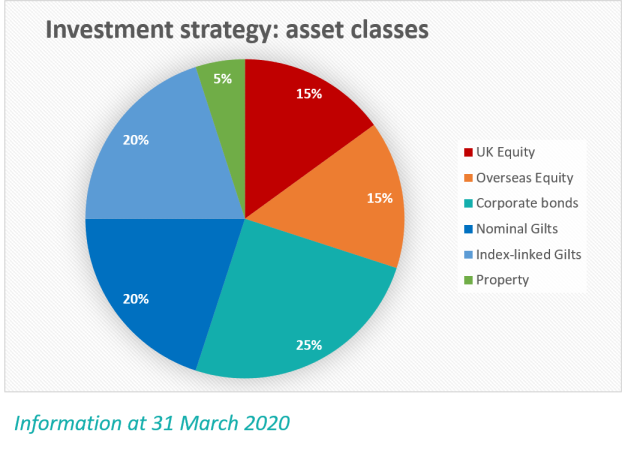

Includes UK/Overseas equities and Property

These asset classes are primarily selected to provide a high long-term investment return.

Managed by [insert name]

Includes investment in corporate bonds, nominal/index-linked gilts and insurance products.

These asset classes are selected to help provide a match between the pension payments made to members and the investment income received by the pension scheme.

Mandates with [insert name]