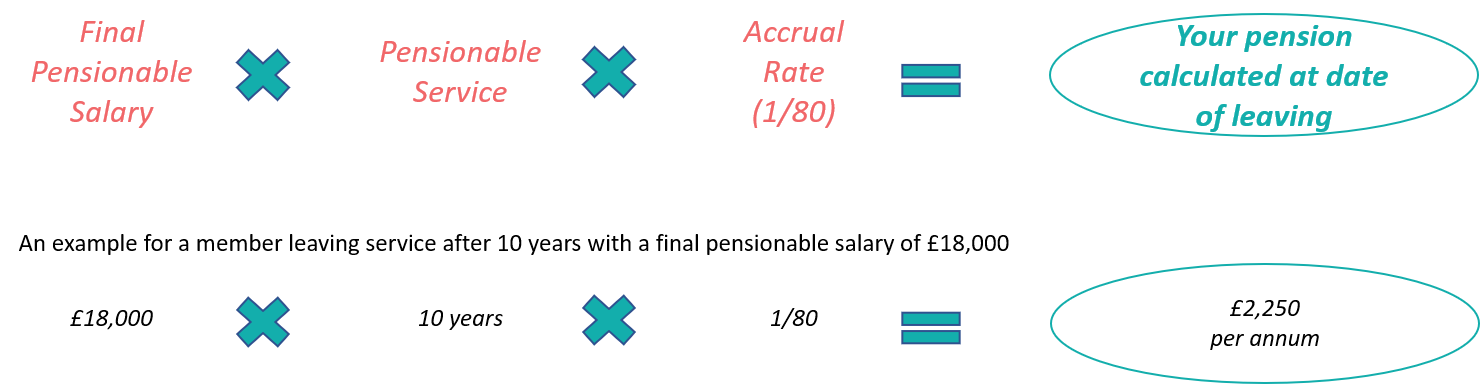

This is your final pensionable salary at leaving employment (as defined in the scheme rules).

Final Pensionable Salary is an average of the Pensionable Salary over the 3 years before leaving employment.

Pensionable Salary includes salary, bonus and overtime over a year ending 31 March.

Normal Retirement Age (NRA) for this scheme is Age 65.

Your full pension entitlement is payable from this age. However, there are also early and late retirement options available to you - follow the Retirement Options link.